5 Compelling Reasons to Embrace Digital Accounting in 2024

The Office of the CFO has transformed dramatically over the last few decades. Events on the world stage have created a turbulent economy. Compliance regulations are constantly changing, challenging finance professionals to adapt and become experts in their field. Yet despite the evolution of the finance function, some challenges remain constant.

- Lack of time: Finance professionals face time constraints, leading to increased pressure and potential errors in completing critical tasks.

- Peak-period frenzy for reporting: During reporting periods, finance teams face pressure to deliver accurate and timely reports, leading to long hours and a stressful working environment.

- Difficulties in ensuring accuracy: Ensuring accuracy in financial reports and statements is challenging. It involves managing multiple data sources and complex formulas, which increases the possibility of human error.

But why are the finance professionals of today still grappling with the same challenges as those of 20 years ago? The answer is simple: while many other industries have embraced digitization, the finance sector still trails behind. Many finance teams still use Excel for crucial tasks like forecasting and financial close, instead of adopting specialized software such as CPM.

CPM (Corporate Performance Management) can be a gamechanger for the Office of the CFO. It automates tasks such as data collection, financial close, planning, and reporting to streamline accounting processes.

If your company is yet to embark on the digital transformation journey, here’s five reasons your finance team could benefit from digitizing your accounting processes with CPM software.

Table of contents

5 reasons to digitalize your accounting processes with CPM

1. Save time

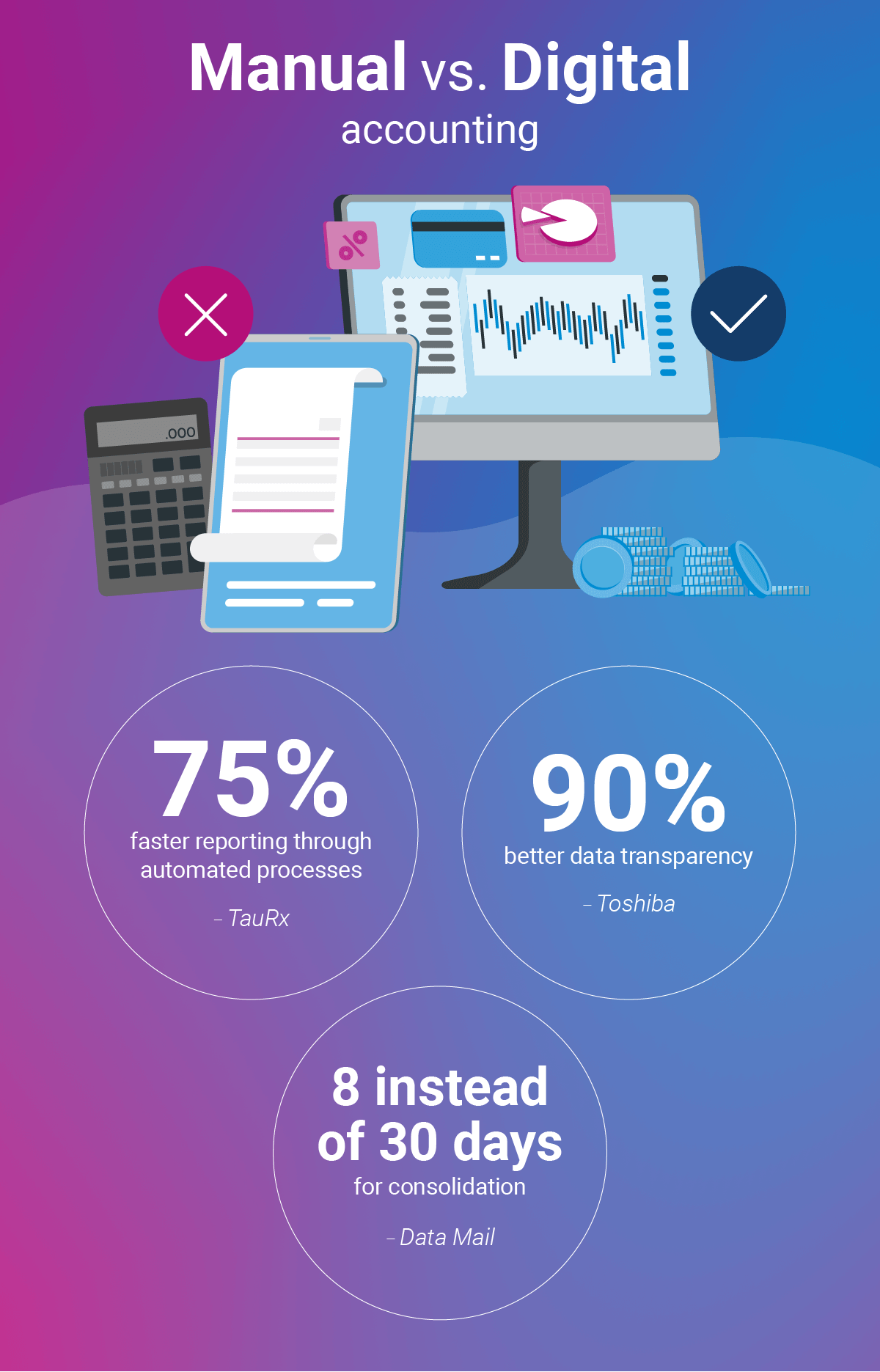

Manual processes, such as the use of spreadsheets, are ubiquitous in the accounting world. Requiring painstaking data entry, consolidation from multiple sources, and complex calculations, these outdated methods are notoriously time consuming and tedious. However, implementing a software solution can streamline and automate these tasks. This means that the hours spent on manual reporting can be drastically reduced, allowing you more time to dedicate to other strategic endeavors.

2. Enhance compliance

One of the biggest drawbacks to manual accounting methods is the heightened risk of error. Overreliance on manual data entry is not only error-prone; due to the transparency and version control issues associated with spreadsheet usage, these errors may not be identified until further down the line.

This can have profound consequences, from key strategic decisions being made on inaccurate data to legal ramifications. By automating data collection, you can eliminate the possibility of human error entirely, and a fully transparent database means you can be confident that every figure is accounted for.

3. Combat stress

Finance is a notoriously stressful profession, defined by long hours and constant deadlines. These challenges and pressures have taken a toll on the mental well-being of finance professionals. Data from ACCA shows that 61% of finance workers say their mental health suffers because of work stress. Furthermore, a staggering 88% of finance workers desire greater work-life balance. Digitalization is the key to empowering finance teams, giving them the tools they need to keep pace with increasingly demanding workloads.

4. Retain talent

With the financial sector experiencing a global skills shortage, it falls on the Office of the CFO to ensure your organization is attractive to top talent. As more young millennials and generation Z enter the workforce, it’s important to acknowledge that this generation of young professionals are digital natives.

This means they have a high level of familiarity with automation and digitization and have the expectation of utilizing it within their workplace. By adopting digital accounting processes, you can appeal to this younger demographic, whilst allowing your organization as a whole to benefit from greater efficiency and accuracy.

5. Gain insight

Digital accounting processes provide you with real-time access to accurate and up-to-date financial data. No more guessing games with complex spreadsheets and multiple data sources, instead you get a transparent overview of all your financial data. This allows you to gain valuable insights into your business performance and make informed decisions.

With CPM you can run scenarios, perform in-depth data analysis, and produce consolidated reports at the click of a button. By making your finance function data-driven, you can drive strategic business growth and stay ahead of the competition.

Empower your finance team with CPM

Ultimately, manual processes can no longer keep pace with the demands of modern corporate finance. By embracing automation and leveraging a data-led approach, you can remain competitive and drive your corporate performance.

Curious about the potential of digitizing your finance function? LucaNet empowers the Office of the CFO by streamlining your reporting, demystifying your financial planning and analysis and automating your consolidation, with one source of truth for all your financial data. Fill out a contact form to speak to one of our team.